Reserves were not so ample after all

Abstract

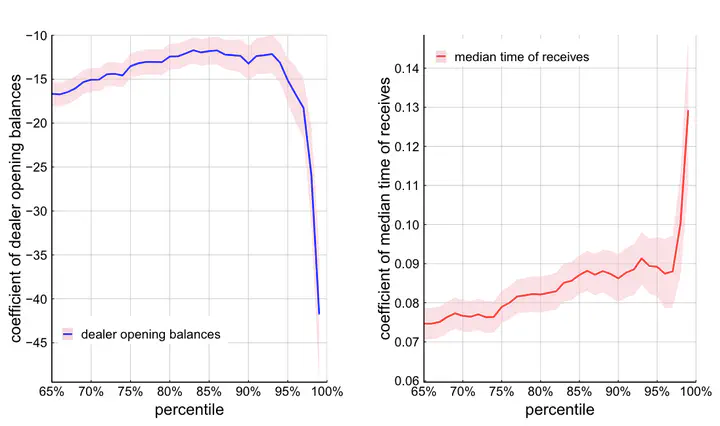

We show that the likelihood of a liquidity crunch in wholesale US dollar funding markets is highly dependent on levels of reserve balances at the financial institutions that are the most active intermediaries of these markets. Heightened risk of an imminent liquidity crunch is signaled by significant delays in intra-day payments to these large financial institutions over the prior two weeks. Our study contributes to the broader dialogue surrounding the Federal Reserve’s ongoing quantitative tightening (QT).

Type

Publication

Accepted, The Quarterly Journal of Economics