Trading with High-Dimensional Data

Abstract

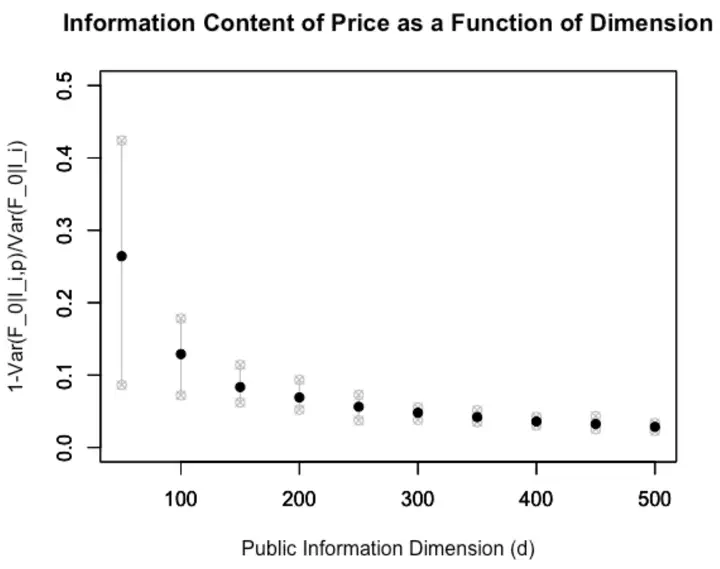

We study a trading game with agents who face a high-dimensional estimation problem. In the presence of a curse of dimensionality, we show rational expectations equilibrium is ε-approximated by a strategy profile in which each agent uses only a ridge regression on her own data to forecast the fundamental’s distribution and does not make inference on price in her demand curve submission. We document how such an equilibrium matches survey evidence about modern trading processes. We derive quantitative properties of price’s prediction risk and equilibrium trading volume, introducing a “regularization externality” in price formation and accounting for trading volume spikes on earnings dates.

Type